If you are into financial markets and are reasonably well versed with the various forex and commodity related investment options, then it is quite likely that you will have some understanding about the CFDs. CFD stands for Contract For Difference and it is about a contract between two individuals or entities to exchange difference between the buying price and selling price or the opening price and closing price, pertaining to that contract. Though there could be many who might believe that CFDs are difficult propositions and there is not much money to be made. However, this may not be the actual fact because there are some obvious advantages and benefits as far as CFDs are concerned and it would be interesting to have a look at the same over the next few lines.

You Can Base Your Contracts On Futures

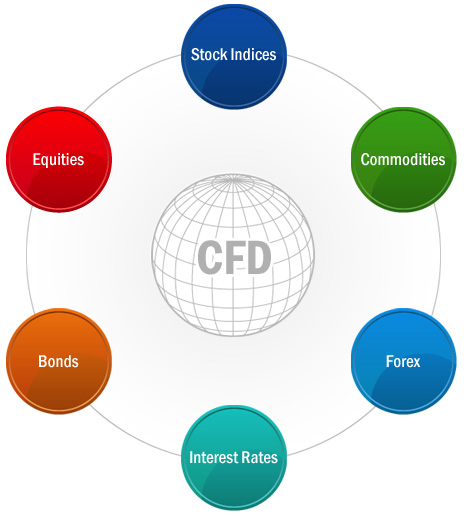

One of the biggest advantages of CFD is that you can use these instruments to make speculation on the movement of market prices in the future. It could be regardless of the fact whether the underlying markets are moving northward or southward. It allows you to sell or go short and therefore make profits out of the transactions. It can also be used as a hedging tool so that any potential loss in the portfolio can be offset as far as physical investments are concerned. Another big advantage is that it offers a huge market and there are more than 12000 markets which you could choose for trading. It certainly will give you a much better and a much wider experience of the markets which perhaps you may never have imagined. It is possible to trade on indices, commodities, currencies, shares and even in many other unconventional ways of making money the legal way. There are many online sources of information and service providers like CMC markets, who can help customers to gain more information and insight as far as CFDs are concerned.

A Few Reasons Why It Makes Sense To Opt For CFDs

There is no need to pay stamp duty as is the case with share trading in the traditional way. This is because the physical ownership of the underlying asset is not transferred from seller to buyer. However, there could be some tax implications and this would depend on a case to case basis. Further since CFDs are products which are leveraged, it would not be necessary for the traders to pay the full amount to trade. Only a fraction amount of payment would be enough to get into the market and trade on the various financial products. This without any doubt enhances the return on investment of quite significantly. However, you should know how to leverage and excess leveraging could result in losses and this could lead to complete erosion of your initial deposit.

It Provides The Ability To Go Short Or Long

CFD trading helps you to get into buying or going long if there is a feeling that the market will rise. On the other hand when the market is in a downturn or turmoil, you could go short or in other words sell and come out with a profit. But it is important to understand the movement of the market and ensure that you go long and go short at the right time. Since the asset transfer does not take place, it is quite obvious that you will not be a big loser even if you have to sell short. This is a big advantage as far as CFD trading is concerned.

It Provides Hedging Facility

Another reason why it might make sense to go in for CFD is because it provides you with hedging facility. If there is a feeling that a part of the portfolio may lose its value, there is a way by which you can use CFD to make good the loss to the complete extent. If you are holding shares of a company worth around $2000 you have the facility of short selling equivalent of these shares through the CFD route. In case the value of these shares falls by 5% in the underlying asset market, you could end up not losing anything because of the profits you could have made by short selling. Hence it is common for many traders to use CFDs as a route to hedge their portfolio more so when the markets are extremely volatile and unpredictable.